Overview

Valuit is dedicated to offering a wide range of services that address the needs of asset owners by leveraging the latest advancements in blockchain technology.

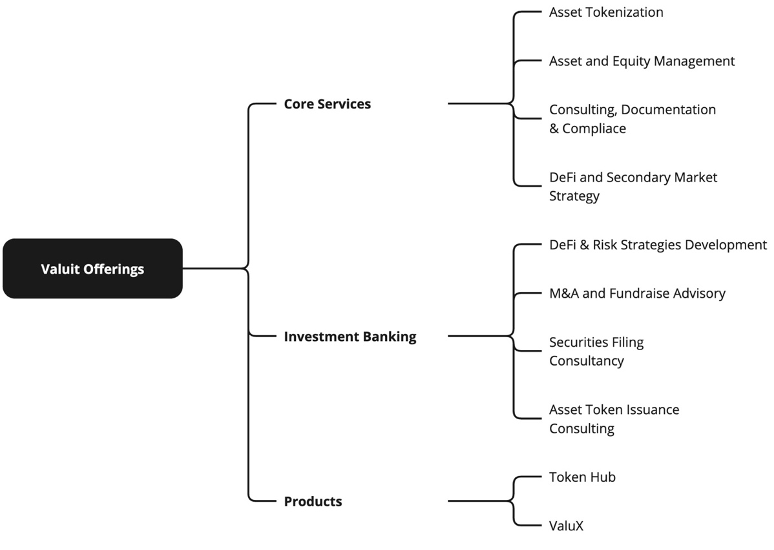

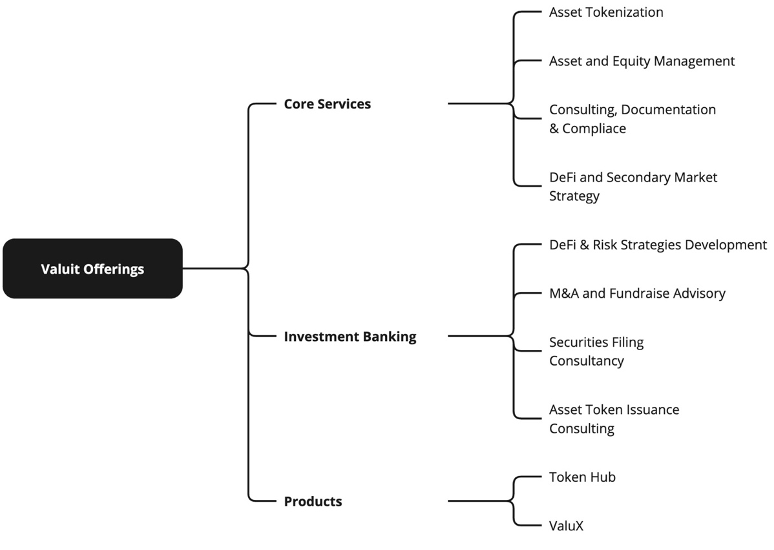

Service Diagram

Tokenization of Assets

| Key Benefits | Description |

|---|

| Enhanced Liquidity | Digital tokens can be traded more easily than traditional assets, providing liquidity to markets that were previously illiquid. |

| Fractional Ownership | Investors can purchase portions of high-value assets, making it easier for a wider audience to invest. |

| Alternative Financing | Blockchain enables alternative financing and leveraging models through decentralized lending and liquidity protocols. |

Asset and Equity Management

| Key Benefits | Description |

|---|

| Operational Efficiency | Automation reduces the need for intermediaries, cutting costs and speeding up processes. |

| Real-Time Information | Shareholders can instantly access up-to-date information about their investments and company performance. |

| Improved Governance | Digital shares facilitate streamlined voting and decision-making processes, enhancing corporate governance. |

Financial Instruments and Investments

| Feature | Description |

|---|

| User-Friendly Interface | Our platform is designed to be intuitive and accessible, providing a seamless user experience for all types of investors. |

| Advanced Security Protocols | We use cutting-edge security measures, including encryption and multi-signature wallets, to protect investments and personal information. |

| Seamless Integration | Valuit's solutions integrate effortlessly with existing financial systems, ensuring a smooth transition and enhanced operational efficiency. |